Cross Selling Dashboard

Roger Knocker • December 3, 2023

Cross Selling Dashboard

Selling new products or services to an existing customer is much easier and far more cost effective!

We have mastered the art of building a cross selling solution using QlikView to find the opportunities, generate the cross-selling leads and monitor the results of the cross selling campaign or initiative.

We have mastered the art of building a cross selling solution using QlikView to find the opportunities, generate the cross-selling leads and monitor the results of the cross selling campaign or initiative.

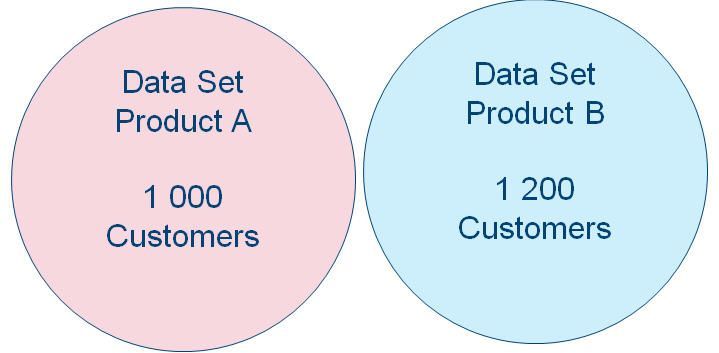

Step 1: Source the Data Sets

Firstly, we identify the data sources where we anticipate cross selling opportunities to exist. Often the two data sets are not already consolidated anywhere in the organisation. It is therefore imperative to be able to consolidate these sources in a short space of time otherwise the exercise stands the risk of becoming a monster.

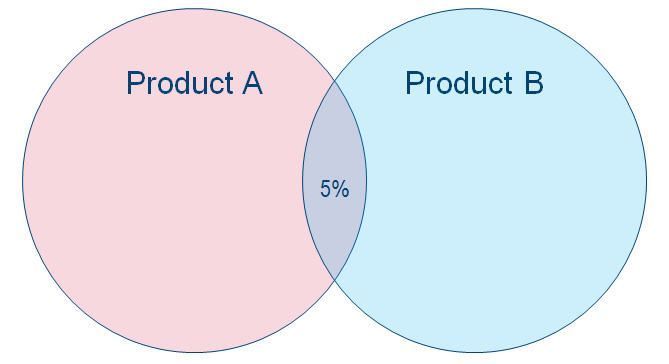

Step 2: Define the current Cross Selling Ratio

We quickly establish what the current cross selling ratio is. This provides a baseline and also quantifies the possible opportunity.

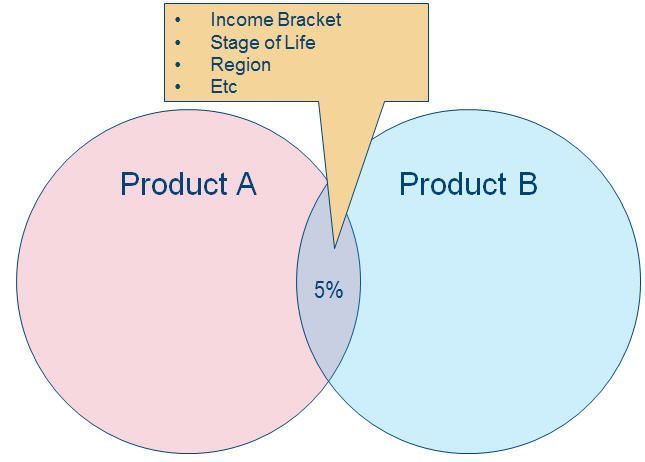

Step 3: Find the Attributes Contributing to the Success

Through a set of advanced algorithms and applied statistical formulas that our data scientists have developed, we quickly narrow down the factors that contribute significantly to the current cross selling success.

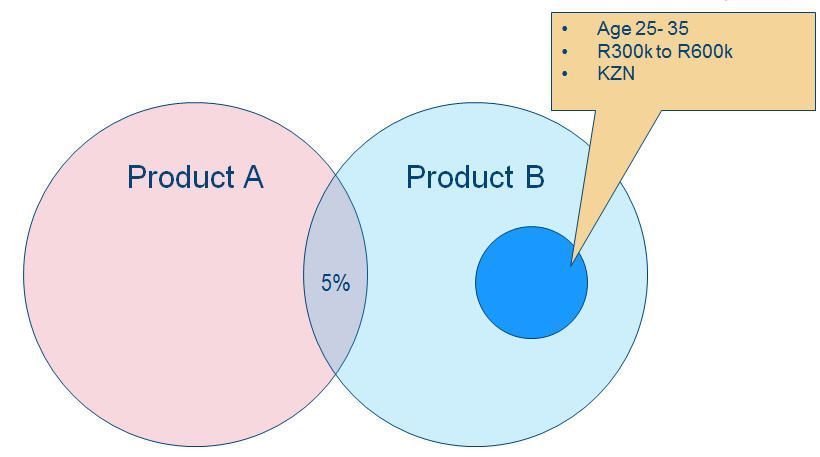

Step 4: Target a Subset of Product B Customers matching the Criteriaa

The solution pinpoints the customers that have a high propensity to buy Product B.

Step 5: Design a Campaign & Generate Data

We use QlikView’s what-if capability to find the expected Strike rates and expected ROI for the campaign.

Once we have the right scenario, we involve the sales and marketing team to provide the right messaging for each group of customers and the dashboard generates the data which is loaded into a CRM system to manage the campaign.

Once we have the right scenario, we involve the sales and marketing team to provide the right messaging for each group of customers and the dashboard generates the data which is loaded into a CRM system to manage the campaign.

Step 6: Implement the Campaign & Measure Results

Once the campaign is in full flight we use QlikView dashboards to continuously monitor the success of the campaign. If necessary we make adjustments quickly and repeat the process.

Although we have simplified the process it still requires exceptional data science and QlikView skills to execute. We suggest getting in contact with us to assess whether or not our solution will work in your environment.

There are no obligations.

Business Benefits and ROI

- Generate internal Leads

- Create Specials

- Increase hit rate of campaigns

- Reduce selling costs

- Grow Revenue

- Grow Group Revenue

- Improve Customer profitability

Next Steps

Although we have simplified the process it still requires exceptional data science and QlikView skills to execute. We suggest getting in contact with us to assess whether or not our solution will work in your environment.

There are no obligations.

In the world of finance, numbers tell a story. However, that story is often buried beneath layers of spreadsheets and complex datasets. For financial professionals, the challenge is not just about understanding these numbers but also presenting them in a way that drives decision-making and inspires action. Enter data visualisation – the art of transforming data into clear, compelling visuals. Among the tools that have proven especially powerful are the line graph and the waterfall chart. These visuals help finance teams translate dry statistics into impactful narratives. In this article, we explore how these graphs can transform financial storytelling. The Importance of Data Visualisation in Finance Finance professionals are accustomed to handling vast amounts of data, from profit margins and revenue growth to expense tracking and risk assessments. Yet, presenting these figures effectively to stakeholders is a different ballgame. Visualisation simplifies this process, turning complex data sets into accessible insights. When done correctly, data visualisation: Enhances comprehension: Humans process visuals 60,000 times faster than text, making it easier for stakeholders to grasp key information quickly. Drives decision-making: Clear and compelling visuals help executives make informed decisions without wading through dense reports. Highlights trends and outliers: Visual tools can bring hidden trends and anomalies to light, prompting timely actions. Improves understanding and communication with business - Business doesn't always get what Finance is trying to communicate and good visualisations go a long way to bridging the gap. Better communication improves alignment to strategic financial goals. The line Graph: Unravelling Trends Over Time The line graph, also known as a stream graph or a stacked area graph, is a powerful tool for visualising changes in data over time. It is especially effective in showing how multiple categories contribute to an overall trend. In finance, line graphs can illustrate revenue streams, expense categories, or investment performance in a visually engaging manner. Use Case: Revenue Streams Analysis Imagine a financial report for a company with diverse revenue streams, such as product sales, services, and subscriptions. A line graph can display how each stream has evolved, highlighting peaks and troughs. The thickness of each ‘line’ represents the contribution of that revenue stream to the total, making it easy to spot which areas drive growth. Benefits of line Graphs: Trends Made Simple: Displays how multiple components evolve over time. Visual Impact: The fluid, organic design makes it easier to follow changes. Comparative Insight: Helps compare different categories intuitively. The Waterfall Chart: Bridging the Gap Between Figures Waterfall charts excel at breaking down the cumulative effect of sequential data points, making them ideal for financial analysis. They help bridge the gap between figures by showing how individual elements contribute to a total. Commonly used in profit and loss statements, budget analysis, and variance reports, these charts provide clarity in understanding how specific actions impact the bottom line. Use Case: Profit and Loss Analysis A financial analyst preparing a quarterly report might use a waterfall chart to demonstrate how various factors—like increased sales, higher marketing spend, and cost savings—impacted net profit. The chart’s structure, with its clear progression from starting figures to the final result, makes it easy for stakeholders to follow the financial narrative. Benefits of Waterfall Charts: Clarity: Simplifies complex financial data by showing individual contributions to total figures. Transparency: Clearly distinguishes between positive and negative impacts. Decision Support: Helps executives understand the key drivers of financial performance. Choosing the Right Visual for the Right Data Selecting the appropriate visual tool depends on the story you want to tell: Use line graphs for illustrating trends across multiple categories over time. Opt for waterfall charts when you need to detail the step-by-step impact of specific factors on an overall financial figure. By mastering these tools, finance professionals can enhance their storytelling, transforming raw data into insights that drive strategic decisions. Conclusion: From Data to Decisions The ability to visualise data effectively is a powerful advantage. The line graph and waterfall chart are more than just visual aids—they are essential tools for financial professionals looking to make data-driven decisions that resonate with stakeholders. By adopting these techniques, finance teams can turn numbers into narratives that not only inform but also inspire action. In the end, the power of finance lies not just in analysing data but in presenting it with impact.